NFTs: Does art still have a place in the bubble?

Article originally published on September 10, 2021 in French in Le Quotidien de l'Art

Six months after the notorious sale of a work in a new format by the artist Beeple at Christie's New York for $69 million on March 11, 2021, what remains of art in the NFT market? Let's start by what this acronym means: NFT = non-fungible token. This is a blockchain-based format that allows artists to create rare or unique digital works (think limited editions with NFTs as opposed to posters without). Since this controversial sale, we have been showered every day with projects, records and predictions of all kinds following three major periods. Let’s take a look back:

March - April 2021: The “Bubble”

When cryptocurrencies reached historic levels, investors sought to diversify their investments by investing in the then-growing segment of NFTs. These first “collectors” were therefore financial players in the crypto world, far from the classic profile of collectors. For example, the buyer of Beeple's work was none other than Metakovan, a crypto investor who used his purchase for entrepreneurial purposes. Many speculators followed, attracted by this lucrative new asset, with very attractive short-term returns on investments, resulting in the total number of NFT buyers rising from less than 20,000 per month in February to over 60,000 in March (source: nonfungible.com).

May - June 2021: The Crash?

The following months saw a decline in the volume of NFT sales with an exit of many speculative players due in particular to a decline in the value of cryptocurrencies and low liquidity of NFTs that were more difficult to flip and sell for an immediate return. But if we look more closely at the data, we see above all a growing market with a “glitch” rather than a “crash”, as evidenced by the data of nonfungible.com which show a stable number of active crypto-wallets, going from 5,000 in February 2021 to 40,000 in March, and only going down to 30,000 in June 2021. As for the artists, they are studying at the format, trying to find their way and explore their options; art galleries remain mostly in the background, uncertain of this new technology which swore to make intermediaries obsolete; and auction houses see a lucrative avenue to ride the wave started by Christie’s, without always fully understanding the format and with a few missteps.

July - August 2021: The Real Bubble?

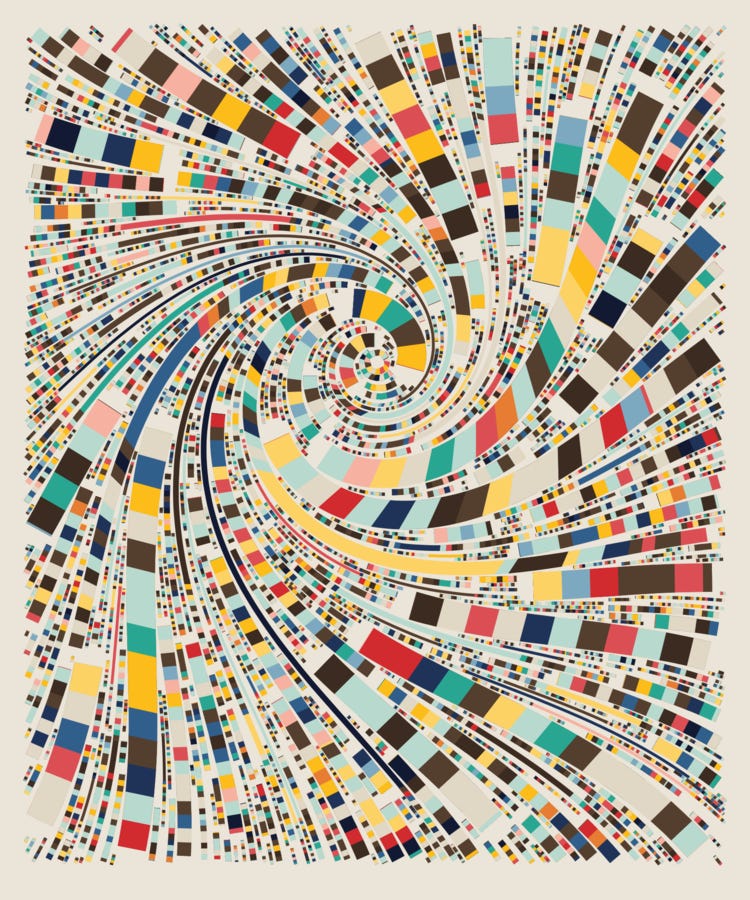

During the summer, NFT projects went back to focusing on collector card and avatar projects of all kinds (what we now call PFP = profile picture), with even higher prices than in March-April. Even art auction houses have capitalized on generative projects, like CryptoPunks, Bored Apes, and other penguins, muddying the waters between collectibles and art, and skewing the data. The summer was also punctuated by announcement effects from the celebrity, sport and video game worlds, with “drops” selling out in seconds. The weekly trading volume of NFTs thus rose from 192 million in May to 1.144 billion dollars at the end of August. What we had taken for a bubble showed 60,000 monthly buyers at the peak of the "bubble" in April against 140,000 in August! A telling example is Tyler Hobbs' generative work, Fidenza 313, which sold on August 23 for $3.3 million (1,000 ETH) after just a few months on the Art Blocks site, whose sales volume was $294 million in August. The summer will therefore have been much more active and "bubbly" than March-April.

Fidenza 313 de Tyler Hobbs - © Tyler HobbsWhat Now?

The start of the 2021-22 school year is heated, and crypto-artists benefit from these sky-rocketting prices. We are witnessing the largest transfer of value ever towards artists in the art market. Works like The Sistine Chapel underground by Pascal Boyart or the 1111 and 888 projects by Kevin Abosch reached record-selling prices in the primary and secondary markets. But let’s not forget that art still represents only 14% of this NFT sales volume of NFTs compared to 66% of “collectibles” (source: H1 2021, nonfungible.com) and that its continuous growth is not guaranteed. To paraphrase Colborn, founder of the Museum of Crypto Art, and Kelani Nichole, founder of the Transfer gallery, artistic value is built over time and has very little correlation to short-term financial value.

The Underground Sistine Chapel by Pascal Boyart, tokenized into 404 NFTs ©PboyThe world of crypto art started with finance and speculation, and is now moving towards a more organized world, with exhibitions, curators and researchers, to ensure recognition of the artistic value of these works in the long term. Art may only remain a tiny part of the NFT market, but the last few months have shown us that there is a strong potential for improving the status quo of the art market and even a potential redefinition of contemporary art. But that this will take time, bubbles, and many more market corrections.

NFT 1111 #0573 by Kevin Abosch © Kevin AboschSee the original article in French

Disclaimer: This English version is a translation done via Google Translate (which was quite good actually) with a few improvements from myself (not a robot).

Great article Fanny. I'm interested that you describe NFT's as "posters rather than limited editions". I would argue that it is in fact, completely the opposite. Apart from the art, the 'limited edition' part of NFT's is the very thing that gives them value.